A Vigorous Rebound

Canada, along with the majority of developed nations,

suffered a major economic downturn over the past few

years. But the strength of the country's banking system —

combined with effective government policies — tempered

the worst impacts, not just preventing the country from

"going over the cliff" economically,

but also helping it

to maintain amazing equilibrium

in the face of widespread

financial chaos. Numerous

studies confirm both Canada's

continuing economic strength

and its competitive business

environment relative to other

nations, not to mention its

remarkable ability to bounce

back quickly from a serious

jolt.

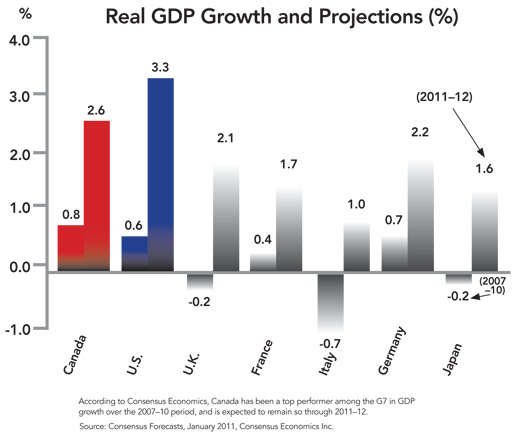

According to Consensus Economics, an international economic survey company headquartered in the UK, Canada has been a top performer among the G7 countries in GDP growth since 2007, and is expected to remain so through 2012. From 2007 to 2010, the country led the G7 with 0.8 percent growth in GDP. The United States was second with 0.6 percent growth. The economic forecasting company projects Canada's rate of growth will climb to 2.6 percent for this year and next.

In the most recent World Competitiveness Yearbook, published in May 2010 by Switzerland-based business school IMD, Canada ranked seventh out of 58 countries studied with regard to its economic future. The publication, which measures countries against four competitiveness factors — economic performance, government efficiency, business efficiency, and infrastructure — singled out Canada for its sound banking regulations and extensive commodity resources.

Even the United States concedes that Canada has generally performed better than other countries, both leading up to and during the Great Recession. November 2010 figures from the U.S. Bureau of Labor reveal that Canada enjoyed overall employment growth of 1.6 percent from 1999 to 2009, compared to only 1 percent for the United States and even lower rates for all other G7 members. According to the Bank of Canada, the nation is expected to return to full capacity and inflation to return to its 2 percent target by the third quarter of this year.

Strong Banks/Fiscally Responsible Government

As noted, Canada's strong banking system and efficient

government are the two primary factors responsible

for the country's current strong economic position.

In fact, the Global Competitiveness Report 2010–11 from

the World Economic Forum in Geneva ranks Canada

first among 139 countries surveyed for the soundness of

its banking system. The organization listed six of the

nation's banks among the 50 safest banks in the world. In

a related finding, the Milken Institute ranked Canada

first in terms of access to capital in an April 2010 index.

Canada has also enjoyed 11 consecutive annual federal

budget surpluses from the mid-1990s through 2008.

Though it ran deficits in 2009 and 2010, the amounts

were relatively small, especially in comparison to U.S.

deficits. A new report prepared by the government's

Invest in Canada bureau attributes the deficits to the creation

of one of the largest stimulus packages among

developed economies during the

recent global economic downturn.

The report projects that the country's

net debt-to-GDP ratio will

not only remain the lowest in the

G7 by a wide margin over the next

few years, but will also return to a

surplus following the 2014–15 fiscal

year.

Real Estate Investment

Increases

Given the strength of its banking

system and its government's

sense of fiscal responsibility, it's

not surprising that Canada's real

estate investment market underwent

a dramatic turnaround last

year. A report from CB Richard

Ellis shows that every market

except one saw volume increases

in 2010, with the Toronto market

experiencing a staggering 93 percent

jump. According to the

report, a stronger economy and

surging investor confidence triggered

a 48 percent increase in total Canadian commercial

real estate investment volume to $18.9 billion. But

while the 2010 results are impressive, the current year

appears likely to be even better.

In 2011, "we expect the real recovery in underlying fundamentals to begin," says Mark Rose, CEO of Toronto-based Avison Young, Canada's largest independent real estate services company. "What we see for 2011 is multinational corporations and other major occupiers of space strengthening their core businesses and beginning to execute on long-term growth plans. As corporate decision-making gathers steam, activity will follow, and…vacancies will start to drop and rental rates will begin to rise."

Historically, Rose notes, Canadian markets tended to lag U.S. recovery by a year. But this time around Canada has taken the lead, with Canadian trophy assets back to 2006–07 levels by fall 2009, a year ahead of its neighbor to the south. In Young's estimation, Canada will continue to see the orderly flow of capital to real estate throughout 2011.

"Interest rates are low, values are compelling, distressed selling is almost nonexistent, and trophy assets are being aggressively fought over as they become available," he states. "There is no panic — there is patience. There is capital and it flows to what 'can be bought' rather than pushing the markets out of equilibrium and forcing cap rates lower and values higher."

Sam Chandan, global chief economist and executive vice president for New York-based Real Capital Analytics, adds that Canadian commercial property and development sites in Canada currently trade at lower price points relative to their long-term cash flow, especially compared to the U.S. and other advanced economies.

More Advantages

Canada's value as an investment market

goes far beyond its ability to rebound

from recession. While the country has a comparatively

high personal income tax rate, as a result of corporate

income tax reductions introduced since 2006, Canada

had the lowest overall tax rate on new business investment

in the G7 in 2010 and will have the lowest statutory

corporate tax rate by 2012. In addition, the country

offers one of the most favorable tax treatments for R&D

among the G7, ranking second only to

France.

Jones Lang LaSalle's Becker lists several additional factors that make Canada extremely attractive for business investment, including continued growth and immigration into the major cities; a broad-based, flexible, and highly skilled labor pool; and a superior education system that enables virtually all qualified candidates to obtain affordable high-level academic or technical training.

Still, Canada's most attractive asset, maintains Phil Dowd, a senior vice president in the Toronto office of Jones Lang LaSalle, is its stability. "We have a very solid financial structure and top-notch physical infrastructure," he says. "It's highly predictable in terms of business planning. We don't drop unexpected surprises. In addition, we offer a very high quality of life. Combined with a dependable labor force and quality education, it makes for a very strong business package."